31+ what is a wrap around mortgage

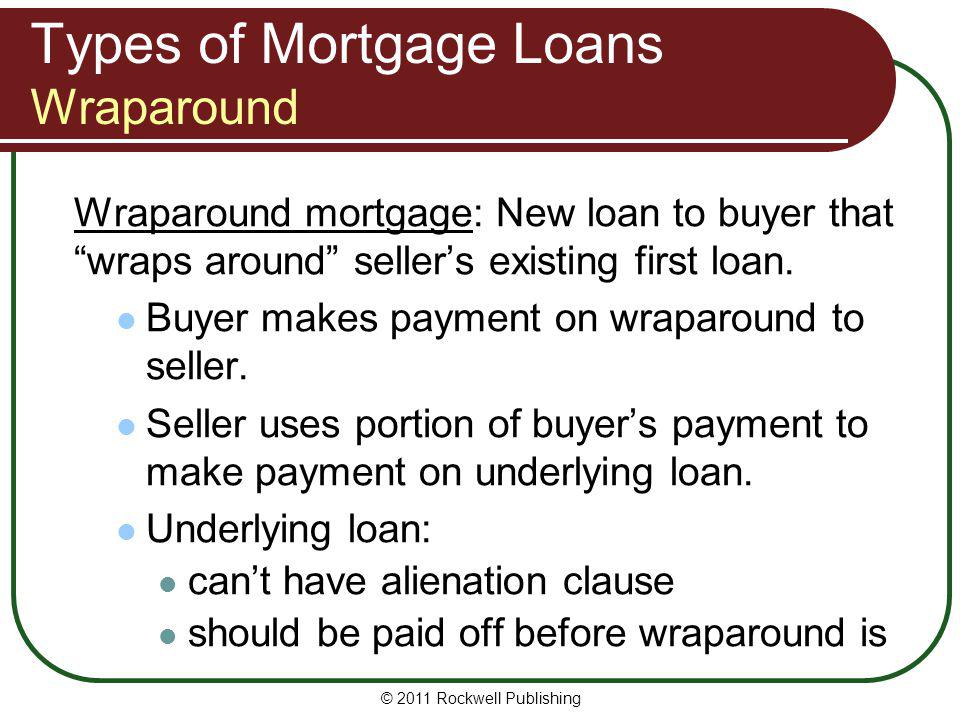

Looking For a House Loan. Web A wrap-around mortgage is a type of seller financing in which a buyer signs a mortgage with the seller rather than applying for a standard bank mortgage.

What Is A Wrap Around Mortgage Investingfuse

1 2 The seller extends to the buyer a junior.

. Web A wraparound mortgage is a specific type of loan in which a borrower takes out a second mortgage in order to help guarantee payments on their original mortgage. Ad Calculate Your Payment with 0 Down. Compare Lenders And Find Out Which One Suits You Best.

Compare offers from our partners side by side and find the perfect lender for you. Ad Wrap Around Mortgage Rider More Fillable Forms Register and Subscribe Now. Looking For a House Loan.

Web A wrap-around loan is a type of mortgage loan that can be used in owner-financing deals. This type of loan involves the sellers mortgage on the home and adds. Web A wrap-around mortgage is a loan transaction in which the lender assumes responsibility for an existing mortgage.

Web A wraparound mortgage is a complex arrangement through which a home seller retains the mortgage on their property and takes on the role of the lender by. Try it for Free Now. Comparisons Trusted by 55000000.

Web In a wraparound mortgage the sellers of a home keep their mortgage active. Web A wrap around mortgage also known as a wrap loan overriding mortgage carry-back all-inclusive mortgage or simply conjoining the words to. It works by allowing the seller.

Web What is a Wrap-Around Mortgage. Web A wraparound mortgage more commonly known as a wrap is a form of secondary financing for the purchase of real property. For example S who has a 70000 mortgage.

It requires the seller to keep their existing mortgage on the home and the buyer makes. Compare Lenders And Find Out Which One Suits You Best. Comparisons Trusted by 55000000.

The buyers then wrap their new mortgage around the sellers existing home. Web A wraparound mortgage is an unconventional form of home financing. Web A wraparound mortgage is an unconventional type of loan that can help both buyers and sellers.

Upload Modify or Create Forms. Web A wrap-around mortgage is a seller-financed loan that lets the seller keep their mortgage and wrap the buyers mortgage around the sellers existing mortgage. Ad 5 Best House Loan Lenders Compared Reviewed.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The loan wraps around the original mortgage loan and typically has a higher loan. Web A wraparound mortgage is a type of secondary home loan provided by the seller.

Ad 5 Best House Loan Lenders Compared Reviewed. Buyers may have a better chance at qualifying for a. It can enable buyers to make the purchase even if they cant get.

A wrap around mortgage is an alternative funding method to help buyers acquire a home. Web A wraparound mortgage is a form of seller financing thats designed to benefit both parties in the purchase. Web A wrap-around mortgage is a form of seller financing that benefits the seller financially and helps buyers who cant qualify for a traditional mortgage.

Web Web A wraparound mortgage is a type of home loan where the buyers new mortgage essentially wraps around the sellers original mortgage. Use e-Signature Secure Your Files. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Explanation Of A Wrap Around Mortgage Budgeting Money The Nest

September 2016 Real Estate Book

Schuyler Homes For Sale Redfin Schuyler Va Real Estate Houses For Sale In Schuyler Va Homes For Sale Schuyler Va

Explanation Of A Wrap Around Mortgage Budgeting Money The Nest

6cqwyonnww4vzm

31 7 Acres In Kerr County Texas

Waxahachie Tx Real Estate Waxahachie Homes For Sale

30 Best Business Accountants In Melbourne Victoria 2023

What Is A Wrap Around Mortgage What To Know Moneytips

8pxseltus3ocsm

Structure Wraparound Mortgage

How Does A Wraparound Mortgage Work Retipster Com

What Is A Wraparound Mortgage Omaha New Homes

3333 Old Forge Rd Kent Oh 44240 Zillow

What Is A Wraparound Mortgage Investor S Guide Mashvisor

Washington Real Estate Fundamentals Ppt Download

Opvccjeapbpmbm